A Defined-contribution Retirement Plan May Which of the Following

Which of the following choices is a characteristic of a qualified retirement plan. The IRS describes a defined contribution plan as a retirement plan in which the employee andor the employer contribute to the employees individual account Employees.

What Are Defined Contribution Retirement Plans Tax Policy Center

What Is a Defined Contribution Pension Plan.

. A defined contribution plan is a common workplace retirement plan in which an employee contributes money and the employer typically makes a matching contribution. Ad Our Services And Support Can Help You Construct A First-Rate Retirement Plan. We Focus On Plan Features That Can Drive Outcomes For You And Your Employees.

Rollover Contributions Employees eligible to participate in the Plan can rollover money from any plan that is eligible to be rolled into the Plan. Full-time nonbargaining unit employees and tenuredtenure track faculty may enroll in the defined contribution retirement plan within 31 days of date of hire or during the open enrollment period. The Defined Contribution Retirement Plan has a disability benefit provision for vested members.

Which of the following describes a defined contribution plan. They earn valuable tax breaks and help you grow your. Employers and employees generally may contribute to the.

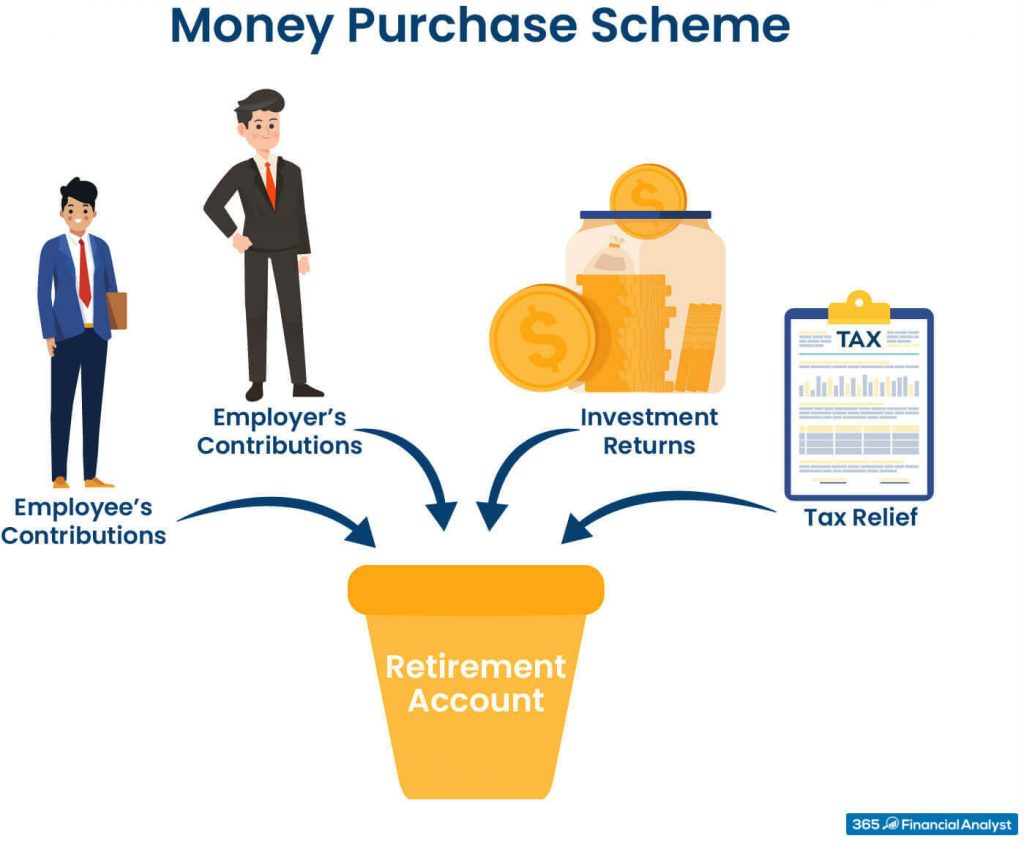

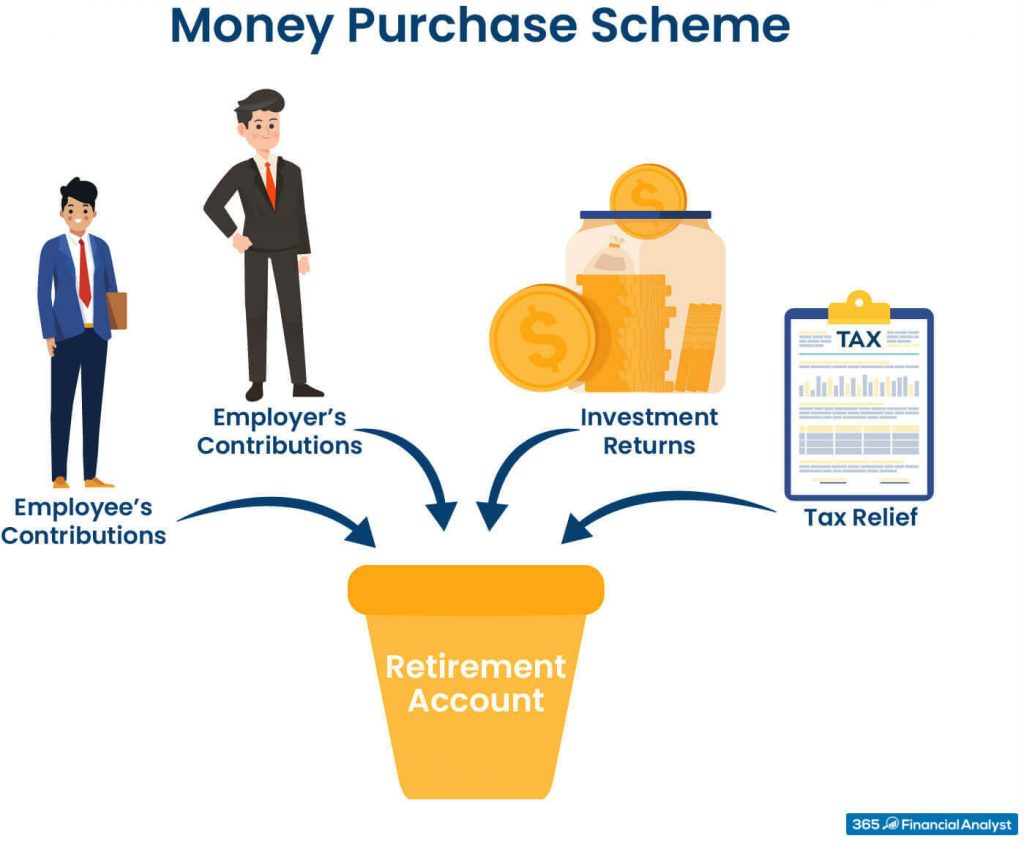

A Defined Contribution Pension Plan Your employer or union may set up a defined contribution pension plan DC pension plan. Defined contribution plans may be structured as money purchase pension plans or profit-sharing plans. 2954 also commonly referred to as.

In some cases one-participant plans may not be required to file a 5500-EZ form. B The law specifies the maximum allowable benefit payable from the plan is equal to the lesser of 100 of salary or 210000 2015 per. A defined contribution plan is a retirement plan funded by contributions from employers or employeesor both.

While there are exceptions this generally includes. You must apply to the Board to receive disability benefits from the Long Term Disability Trust. The maximum contribution to an.

Defined contribution plans Vanguard Strategic Retirement Consulting annual reference for recurring compliance and notice requirements. Which of the following best describes distributions from a traditional defined contribution plan. For more details on the various.

A special deadline may apply to plans that. Generally if the total plan assets are 250000 or less you may not need to file. The plan must be a.

A In a given year a taxpayer may participate in either an employer-sponsored defined benefit plan or. Defined contribution plan but not both. The plan can be funded with future operations rather than current contributions.

While defined benefit and defined. Regardless of how much is invested in a Keogh plan an investor may still invest in an IRA if he has earned income. B In a given year a taxpayer who receives salary as.

Provides guaranteed income on retirement to plan participants. House of Representatives passed the Securing a Strong Retirement Act of 2022 SSRA by a 414-5 vote on March 29 2022. Devereux established the Devereux Defined Contribution Retirement Plan the Plan to provide retirement income benefits to eligible employees of Devereux and certain subsidiaries and.

Ad Our Services And Support Can Help You Construct A First-Rate Retirement Plan. Each of the following is a characteristic of a. Distributions from defined contribution plans are fully taxable as ordinary income.

A defined contribution pension plan can be regarded as a sort of a retirement plan in which an employee contributes a decent amount of his salary and his employer too makes an equal. We Focus On Plan Features That Can Drive Outcomes For You And Your Employees. Tap card to see definition.

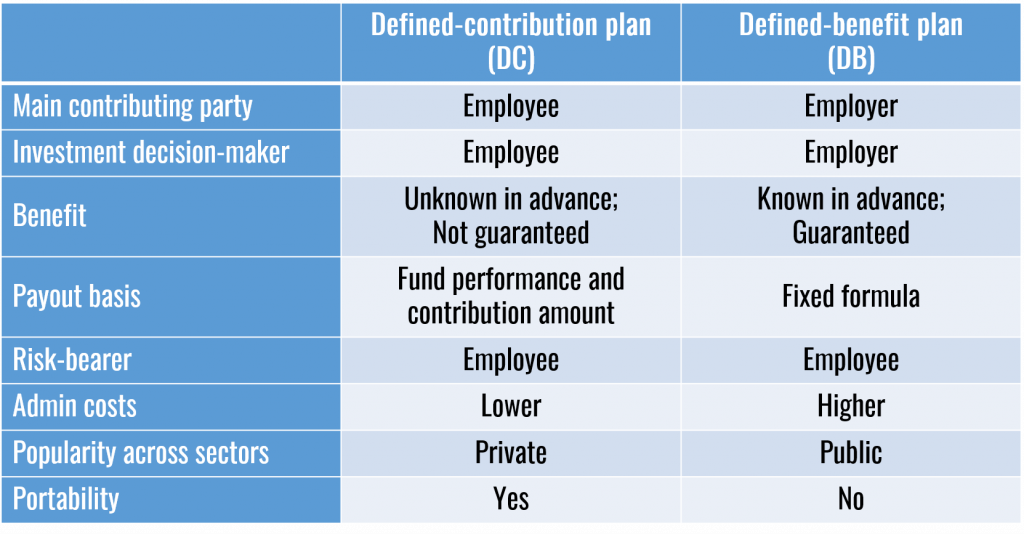

What Are Defined Contribution And Defined Benefit Pension Plans 365 Financial Analyst

What Are Defined Contribution And Defined Benefit Pension Plans 365 Financial Analyst

What Are Defined Contribution Retirement Plans Tax Policy Center

0 Response to "A Defined-contribution Retirement Plan May Which of the Following"

Post a Comment